“Well WalletPllus was a scam and that makes u????”

His inference, that WP was a scam, and therefore, so was I, is typical quid pro quo logic, as though I operated WP and was responsible for its failure and bilking the public. There was no consideration that I lost money too, and had not yet gained sufficient knowledge or understanding that might have caused me to avoid that particular platform or others like it, or even advise people against depositing in such vehicles.

However, “losses” are only losses if nothing is learned. Losses will continue to accrue until the lesson is learned, at which time the losses become tuition on one’s path to knowledge, understanding, and even mastery.

Due to what I had begun learning about bitcoin and money, two very different commodities, I didn’t stop losing. I was quite determined to build my own “reserve” of value instruments, even though my meager resources were now even more so.

Leveraged and Cooperative Accumulation

I saw accrual platforms that take advantage of trading and networking strategies as a way to leverage meager resources and turn them into substantial reserves in a short period of time. Yes you could certainly “buy and hold” bitcoin, but there’s less chance anything is learned the “coin” is treated like an object that it isn’t. Bitcoins are best used as instruments of value exchange between people, not ceremonial items to be hoarded.

Seeing or sensing that a major, unprecedented, historic shift was at hand, I threw myself into the subject and process of accruing bitcoin via platforms that seemed to spring up, one promising more than the next, each day.

One critical omission in thinking: it never occurred to me that the sites themselves might not last. That fact was driven home time and time, site and site again.

- Ecoinplus.com

- BetRobot (via Telegram)

- Bitcoin’s Brain

- Bitwise.biz

- Bitgrow.biz

- Coinexpro.com

- CrypSy (via Telegram)

- Clary (via Telegram)

- Gladiacoin.com

- MrCryptocoin.com

- Jet-coin.com

- Fundstream.com

- Bitlove.com

My losses have turned into lessons, as I learned what to look for, as well as what to require from a prospective accrual service. While there are no “guarantees” of success or longevity in the world of investments, there are a few clues that some would think are “no brainers”.

- No name of anyone who actually works for the company.

- No phone numbers

- No pictures or videos of the actual people behind the platform

- No social media presence or activity

- Boilerplate descriptions in broken English or poor grammar

There are more, but I admit that I was willing to put money in, largely on the novelty of the new, and the success that others reported. None of these factors could address the potential for longevity.

No Sector is ‘Too Pure to Scam’

But longevity isn’t a question for new paradigm platforms. Established organizations can also be up to their literal ears in fraud.

Here is a short list of events perpetuated by “respectable” businesses that give the word “SCAM” true meaning, having affected millions of lives and trillions of debt instruments.

- Lehman Brothers

- Merrill Lynch

- Wells Fargo Bank

- Goldman Sachs

- Savings & Loan Debacle

- HSBC

As you can see, there is no shortage of instances of intent to defraud by these, and other firms in the private and pubic sectors, yet, many are still in operation, their “sins” unpunished and for all practical purposes, forgiven.

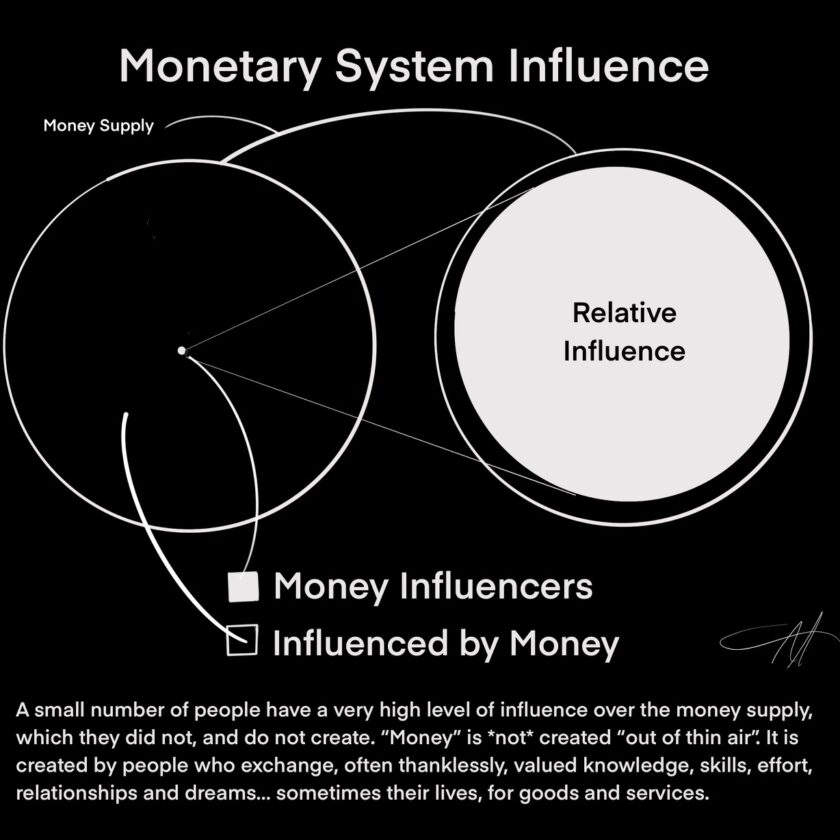

Irrespective of who is behind these “Mayfly accrual platforms”, or what their intent, the main beneficiary of a decision by the general population to stay out of the crypto space, *or by regulatory pundits to prop old school money managers over it as regulating authorities,* would be the banking cartel, which would mean extending The Debt Age.

If we see the inevitability of a destructive course and allow it anyway, then what does it make *us*?